Digital disruption in the retail industry

Over the past decade, the retail landscape has shifted dramatically. Shoppers no longer tolerate long checkout lines, confusing return policies, or one-size-fits-all assortments. Instead, they expect frictionless checkout, personalized offers, and the ability to buy, return, or exchange products anytime and anywhere.

The stakes are high: according to McKinsey, retailers that lead in digital transformation generated 3.3 times higher total shareholder returns between 2016 and 2020 compared to laggards. In today’s environment, digital transformation is not just a “project” but the operating system for survival and growth.

Importance of digital transformation in the retail industry

The retail industry is facing three structural challenges:

Customer disconnect: Traditional stores often struggle to keep pace with expectations shaped by e-commerce. For instance, Target reported that its Drive Up service—which lets customers pick up purchases curbside—became one of its fastest-growing offerings, driving both loyalty and incremental sales.

Supply chain inefficiency: Legacy retailers suffer from slow inventory turnover and frequent stockouts. Walmart, by contrast, has invested in AI-powered forecastingand automated warehouses to improve replenishment accuracy and reduce out-of-stock rates.

Stagnant physical space: The store of the past was purely transactional. Today, leaders like Sephora and IKEA are using augmented reality (AR) to turn stores and apps into interactive experience centers that drive both engagement and conversion.

What is digital retailing?

Digital transformation is often misunderstood as simply adding new gadgets or building a flashy app. In reality, it’s about redesigning decision-making and operating models around four pillars:

1. Customer-centric journeys(from browsing to checkout to returns).

2. Unified data foundation(a single source of truth for inventory, pricing, and customer identity).

3. Modular technology platforms(so retailers can innovate faster).

4. Product-oriented teams(cross-functional squads focused on customer outcomes, not just projects).

The Benefits/Impact of Digital Transformation in Retail

The impact is measurable across three dimensions:

Growth: Higher conversion, bigger basket sizes, and new revenue streams like retail media. Walmart’s advertising arm, Walmart Connect, reported 30%+ year-on-year growth in 2023.

Efficiency: Automation reduces labor costs and human error. Self-checkout and mobile POS systems help retailers like Tesco and Carrefour reduce queue times while lowering staffing requirements.

Resilience: Digital tools improve the ability to respond to supply disruptions. For example, Walmart’s route optimization software cuts fuel usage and ensures deliveries even under stress conditions.

Quick Wins: How to Start in 6–12 Months

Retailers don’t need billion-dollar budgets to see results. The fastest paybacks come from upgrading high-impact customer journeys:

Buy Online, Pick Up In Store (BOPIS) & Curbside Pickup: Target transformed its Drive Up service into a “multi-moment” experience—allowing returns and even coffee pickup from Starbucks partnerships, boosting both satisfaction and frequency. Kroger reported that online pickup services doubled in demand during the pandemic

Hassle-free returns: Amazon’s Kohl’s in-store return program simplified returns for millions of customers, increasing store visits for Kohl’s by double digits.

Formula: select 3–5 high-frequency journeys → define clear KPIs (e.g., fulfillment speed, return cycle time) → run small pilots → scale what works.

Building a Data Foundation: The Single Source of Truth

Data silos remain the biggest barrier to transformation. A practical roadmap:

1. Harmonize core tables: product, inventory, and price—ensuring store and online consistency.

2. Unify identity and consent management: enabling personalization while respecting privacy regulations (GDPR, CCPA).

3. Reusable data pipelines: start with one or two high-value use cases (e.g., replenishment, recommendations) and expand gradually.

This ensures every decision—from restocking bananas to pricing electronics—is based on the same trustworthy dataset.

Best Digital Tools for Stores and Supply Chains

Mobile POS: Speeds up checkout, reduces queues.

Self-checkout kiosks: Improve throughput, lower labor costs.

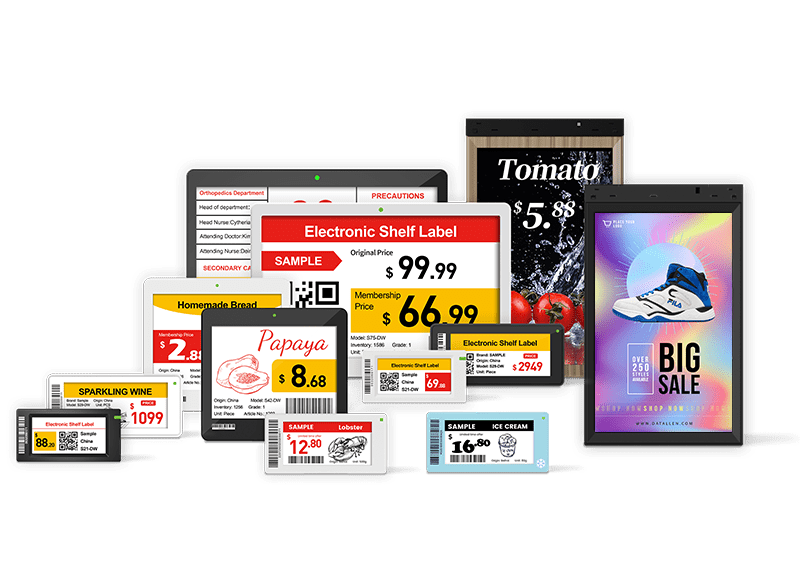

Digital signage: Provides real-time promotions and personalized offers.

Computer vision shelf monitoring: Detects out-of-stock products instantly.

Electronic shelf labels: These allow instant price updates across thousands of products, improving pricing accuracy, reducing labor, and enabling dynamic promotions.

RFID tracking: Boosts inventory accuracy, as seen at Decathlon.

AI forecasting and routing optimization: Increases supply chain resilience, reduces waste.

Warehouse robotics: Enhances order fulfillment speed and accuracy.

Operating Model Shift: From Projects to Product Teams

Leading retailers are moving away from siloed IT projects. Instead, they organize around product domains like “checkout,” “returns,” or “loyalty.” Cross-functional teams manage continuous improvement, run A/B tests, and deliver incremental value every quarter. Retailers like Marks & Spencer have adopted cross-functional squads that own key journeys (e.g., checkout, returns), focusing on continuous improvement rather than one-off IT projects.

In-Store Digitization That Delivers

Digital investments must prove their worth in numbers:

Self-checkout: Reduces wait times, increases throughput, and boosts repeat visits.

AR try-on (Sephora): Significantly improved conversion by helping customers visualize makeup in real time.

Smart fitting rooms (Ralph Lauren flagship): Interactive mirrors let shoppers request sizes without leaving the booth.

Cybersecurity & Privacy in Omnichannel Retail

Trust is non-negotiable. Retailers must adopt:

Multi-factor authentication for staff.

Segmented networks to limit breaches.

Immutable backups and recovery drills.

Transparency in algorithmic pricing and recommendations, with clear opt-outs for consumers.

Change Management That Store Teams Will Support

Technology adoption fails without frontline buy-in. Retailers should:

Involve store staff in process co-design.

Provide training in data literacy and AI assistants.

Align incentives with customer-centric KPIs.

When employees see immediate relevance, adoption curves shorten dramatically.

Metrics That Prove the Value

Growth: conversion rates, app penetration, retail media revenue.

Efficiency: markdown speed, order-picking minutes per order, and inventory turnover.

Resilience: mean time to detect (MTTD) and resolve (MTTR) disruptions, stockout recovery time.

A/B testing and control-zone pilots provide credible attribution.

Roadmap by Retailer Size

SMBs (0–6 months): cloud POS, basic inventory sync, curbside pickup, simple dashboards.

Mid-market (6–18 months): unified identity, price/inventory consistency, scale two or three digital journeys.

Enterprises (12–36 months): modular platforms, data contracts, industrialized DevOps & FinOps.

Build vs Buy Decisions

Evaluate each technology using four lenses:

1. Speed to value

2. Differentiation potential

3. Lifecycle cost

4. Exit flexibility

Contracts should safeguard API access, data portability, SLAs, and exit clauses.

Sustainability and ESG Benefits

Digital operations drive sustainability too:

Smarter demand forecasting reduces food waste.

Route optimization cuts carbon emissions.

Digital returns and recommerce create second-life product channels.

Digital Transformation Retail Case Study

Walmart: AI forecasting and automated fulfillment centers improved inventory accuracy and cut logistics costs, while offering route optimization as a SaaS product.

Target: Drive Up expanded from pickup to returns and Starbucks delivery, strengthening omnichannel loyalty.

Kroger: ESLs and smart shelves improved inventory accuracy.

Decathlon: RFID improved logistics and reduced shrinkage.

Ralph Lauren: Smart fitting rooms enhanced customer engagement.

FAQs Retail Executives Ask

Q: How fast is ROI?

A: Customer-journey pilots deliver results in 3–6 months, while platform foundations take 6–12+ months.

Q: Which metrics should reach the board?

A: Growth, efficiency, resilience.

Q: Which tech to build vs outsource?

A: Core differentiators (e.g., customer journey design) are built; infrastructure (e.g., cloud, IoT) is often outsourced.

Q: How to protect privacy while personalizing?

A: Use minimal, explainable, and revocable data.

Q: Will associates be replaced?

A: No—roles are redefined. For example, automation frees staff to focus on customer care.

Conclusion

Digital transformation in the retail industry is not about replacing humans with machines—it’s about enabling humans to do what they do best: serve customers, build relationships, and create value. The winners will be those who invest not only in technology but in data foundations, operating models, and people-centric change.

For more insights, check out:

1. Retail’s Paperless Shift- Key Technologies Driving Green Retailing

2. Electronic Labels vs. Manual Tags: Cost & Efficiency Analysis for Modern Retailers

3. How Much Does It Cost to Open a Smart Store with e Price Tags?

4. Supermarket-Grocery Inventory Management: Transforming Overstock Woes into Profit Engines

5. How Retailers Can Use Window Display Ideas to Drive More Foot Traffic